High-Income Property Investing: Techniques for Optimum Revenue

Property investing has actually long been a pathway to constructing wide range, however high-income realty investing takes this to the next level. By targeting high-yield properties and applying critical investment approaches, investors can achieve substantial returns. Whether you're aiming to produce substantial easy income or grow your portfolio, this overview checks out techniques and pointers for effective high-income property investing.

What is High-Income Property Spending?

High-income property investing concentrates on acquiring and managing properties that create above-average returns. These financial investments usually involve:

Luxury homes: Premium apartment or condos, vacation homes, or commercial spaces.

High-demand services: Properties in prospering markets or prime places.

Business investments: Office complex, retail spaces, or commercial homes.

By focusing on possessions with greater gaining prospective, financiers can produce a portfolio that consistently outmatches typical real estate investments.

Secret Characteristics of High-Income Property

Prime Locations: Feature in metropolitan centers, vacationer hotspots, or wealthy areas.

Premium Features: Attributes like modern-day layouts, clever home innovation, or resort-style facilities.

Solid Demand: A consistent stream of occupants or purchasers going to pay costs rates.

Scalability: Opportunities for residential property recognition or rental increases with time.

Advantages of High-Income Property Investing

1. Higher Returns on Investment

High-income residential or commercial properties typically produce dramatically higher rental revenue contrasted to basic financial investments.

2. Home Admiration

High-end and prime-location residential or commercial properties often value faster, offering significant long-term gains.

3. Diversified Revenue Streams

Numerous high-income financial investments, such as temporary leasings or commercial leases, offer multiple income possibilities.

4. Tax obligation Benefits

Financiers can benefit from tax breaks like depreciation and cost reductions, even more enhancing profitability.

Methods for High-Income Property Investing

1. Focus on High-end Rentals

High-end apartment or condos, suites, and penthouses are highly sought after in upscale locations. These buildings bring in well-off lessees willing to pay costs rental fees for premium services and prime areas.

2. Invest in Short-Term Rentals

Temporary vacation services in preferred locations fresh York City, Miami, or Los Angeles deal exceptional income possibility. Make use of platforms like Airbnb or Vrbo to optimize exposure.

3. Explore Commercial Real Estate

Investing in office, retail facilities, or industrial warehouses can generate high month-to-month earnings from long-term leases with organizations.

4. Add Worth Through Renovations

Updating residential properties to consist of modern styles, energy-efficient functions, or luxury amenities can dramatically boost rental or resale worth.

5. Target Arising Markets

Identifying up-and-coming communities or cities with expanding need guarantees you buy at a reduced cost with high possible returns.

Challenges of High-Income Property Spending

1. High Initial Financial Investment

Getting high-income homes frequently needs considerable funding. High-end residential properties and industrial spaces can be pricey upfront.

2. Market Sensitivity

Economic downturns or changes in market demand may affect rental prices and occupancy levels.

3. Administration Intricacy

Properties with high-income possible often require expert administration to maintain top quality and attract tenants.

4. Regulatory Restrictions

Temporary rental https://greenspringscapitalgroup.com/ markets and deluxe advancements may face zoning laws or other lawful restrictions.

Top Areas for High-Income Realty Investing

1. Urban Centers

Cities like New York, San Francisco, and Chicago offer high rental need and admiration capacity.

2. Vacationer Hotspots

Areas like Miami, Las Vegas, and Orlando are ideal for temporary getaway rentals.

3. Technology Hubs

Cities such as Austin, Seattle, and Denver draw in high-earning professionals looking for premium housing.

4. International Markets

Investing in worldwide cities like London, Dubai, or Tokyo can open doors to lucrative chances.

Tips for Successful High-Income Realty Investing

1. Conduct Thorough Marketing Research

Understand the regional real estate patterns, residential or commercial property need, and competition in your target audience.

2. Partner with Experts

Deal with seasoned real estate agents, home supervisors, or investment company specializing in premium properties.

3. Take Advantage Of Financing Choices

Discover loans or investment partnerships to obtain high-value properties without overextending your sources.

4. Focus On Occupant Experience

For high-end leasings, guarantee tenants receive extraordinary service and features to validate superior rates.

5. Display and Change

Frequently examine your portfolio's performance and adapt to market adjustments to suffer profitability.

Study: High-Income Investing Success

The Luxury Home Strategy

An financier purchases a deluxe apartment or condo in midtown Manhattan for $3 million. By furnishing it with high-end devices and offering short-term leasings to company travelers, https://greenspringscapitalgroup.com/ they create $15,000 month-to-month revenue, accomplishing a 6% yearly ROI.

Commercial Financial Investment in Arising Market

An investor acquires a retail area in Austin for $1 million. Leasing it to a successful regional organization produces $8,000 monthly in rent, with possible appreciation as the city grows.

High-income realty spending deals an outstanding possibility for investors to create considerable returns, provided they utilize the right techniques and market understanding. From luxury rentals to industrial properties, the capacity for growth and productivity is tremendous. By investigating markets, partnering with professionals, and maintaining a aggressive method, you can build a successful portfolio that makes certain High-income real estate investing long-lasting wide range.

Take your initial step into high-income property today and unlock the potential for exceptional economic benefits.

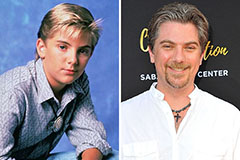

Tahj Mowry Then & Now!

Tahj Mowry Then & Now! Jeremy Miller Then & Now!

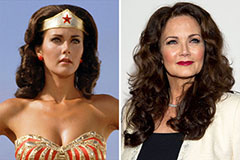

Jeremy Miller Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Batista Then & Now!

Batista Then & Now! Daryl Hannah Then & Now!

Daryl Hannah Then & Now!